📑Table of Contents:

As an Amazon seller operating in the EU/UK, staying compliant with VAT regulations is crucial for maintaining a smooth business operation. However, a significant change will affect many sellers—Avalara, your current VAT service provider through Amazon, will be exiting the VAT Services on Amazon program as of November 1st, 2024. This change could impact your business, but Amazon has taken steps to ensure a seamless transition by partnering with Taxually as the new VAT service provider.

Understanding the Change

Avalara has been a trusted partner for Amazon sellers, providing VAT services that help you comply with the complex tax regulations in the European and UK markets. However, due to Avalara’s upcoming exit from the program, Amazon has coordinated with Taxually to take over these responsibilities.

The transition process is designed to be straightforward. On October 31st, 2024, Amazon will automatically unsubscribe you from Avalara’s services. To continue your VAT services seamlessly, you need to confirm your transfer to Taxually within the next ten business days.

What is Taxually?

Taxually is a specialized tax technology company focused exclusively on providing comprehensive VAT (Value-Added Tax) compliance services across multiple jurisdictions, particularly in the European Union (EU) and the United Kingdom (UK). With the increasing complexity of VAT regulations, especially for businesses operating across borders, Taxually offers a suite of automated solutions designed to simplify the compliance process for companies of all sizes, including e-commerce giants like Amazon.

Why the Transfer?

- Enhanced Specialization in VAT Compliance:

- Taxually is a company that specializes exclusively in VAT compliance, offering tailored solutions that focus solely on the complexities of VAT regulations across the EU and UK. This specialization may provide Amazon with more accurate and efficient compliance services.

- Improved Integration with Amazon Systems:

- Taxually likely offers more seamless integration with Amazon’s existing systems, which can streamline the process of VAT calculation, reporting, and filing for sellers. This can reduce errors and improve the overall user experience.

- Cost-Effectiveness:

- The decision to switch to Taxually might be driven by the need to lower operational costs while maintaining high service standards. It could offer a more competitive pricing structure, which benefits both Amazon and its sellers.

- Regulatory Compliance and Updates:

- The ever-changing landscape of VAT regulations requires constant updates and adjustments. Taxually’s ability to stay ahead of these changes and ensure that Amazon’s compliance processes are always up-to-date might be a key reason for the transfer.

Benefits Expected from This Transition

Greater Accuracy and Efficiency:

- By leveraging Taxually’s expertise, Amazon expects to achieve greater accuracy in VAT compliance, minimizing the risk of errors that could lead to penalties or even audits.

Streamlined User Experience for Sellers:

- Moreover, the integration with Taxually is anticipated to simplify the VAT compliance process for sellers, allowing them to manage their VAT obligations without extensive administrative burdens.

Enhanced Customer Support:

- Taxually may also offer more robust customer support services, ensuring that sellers have access to timely and accurate assistance when dealing with VAT issues.

Scalability and Future Growth:

- As Amazon continues to expand its operations in the EU and UK, partnering with a VAT service provider like Taxually that can scale with its growth is crucial. Taxually’s ability to adapt to Amazon’s growing needs is likely a key benefit of the transfer.

Key Areas of Expertise

- Automated VAT Registration: Helping businesses register for VAT in various countries seamlessly.

- VAT Calculation and Filing: Offering precise calculation of VAT obligations and ensuring timely submission of returns to tax authorities.

- Real-Time Reporting: Providing real-time VAT reporting capabilities that align with specific country requirements.

- Cross-Border VAT Management: Managing VAT compliance for businesses that sell goods across multiple countries, reducing the administrative burden associated with cross-border transactions.

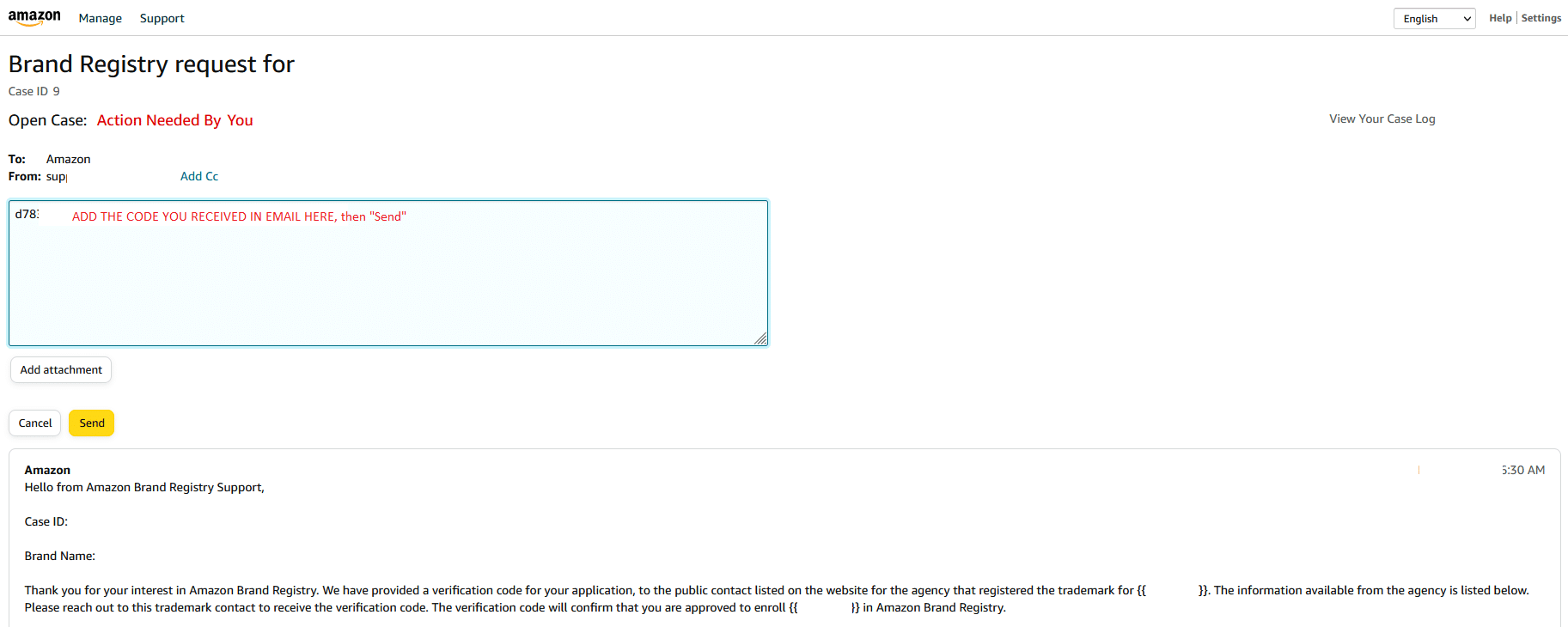

How to Transfer to Taxually

Transferring your VAT services to Taxually is a simple process. Amazon has provided a step-by-step guide to assist you in this transition. Here’s what you need to do:

- Locate Your Merchant Token: First, ensure you’re signed into Seller Central. Click on the link provided by Amazon to find your Merchant Token. This token is essential for the transfer process.

- Provide Contact Details: You must enter your phone number and email address. These details will allow Taxually to contact you with updates, issues, and next steps regarding your VAT compliance.

- Confirm the Transfer: Once you’ve entered your Merchant Token and contact details, confirm that you wish to transfer to Taxually. I will contact you within ten business days to finalize the transition.

What to Expect from Taxually

A well-established VAT service provider will take over where Avalara leaves off. They have been working closely with Amazon to ensure a smooth transition for all sellers. Taxually is committed to contributing to your business growth by providing the necessary tools and support to keep your VAT compliance in check.

By transferring to Taxually, you can expect continued compliance with VAT regulations across the EU/UK, minimizing disruptions to your business. Taxually’s platform is user-friendly and designed to handle the complexities of cross-border VAT. It also ensures that you remain compliant with all necessary regulations.

Final Thoughts

This transition may seem daunting, but it is necessary to ensure that your business continues to operate smoothly in the European and UK markets. By confirming your transfer to Taxually, you are taking proactive steps to maintain compliance and avoid potential disruptions in your VAT obligations.

Remember, the deadline to confirm your transfer is 10 business days away. Follow the steps provided by Amazon and Taxually to secure your business’s future in these key markets.