📑Table of Contents:

In the volatile world of cryptocurrency trading, distinguishing between genuine market trends and deceptive signals is crucial. The bear trap stands out as a particularly cunning obstacle among the myriad of challenges traders face. This blog post dives into the bear trap, shedding light on what it is, how it works, and how to avoid falling into its grasp as a trader or investor.

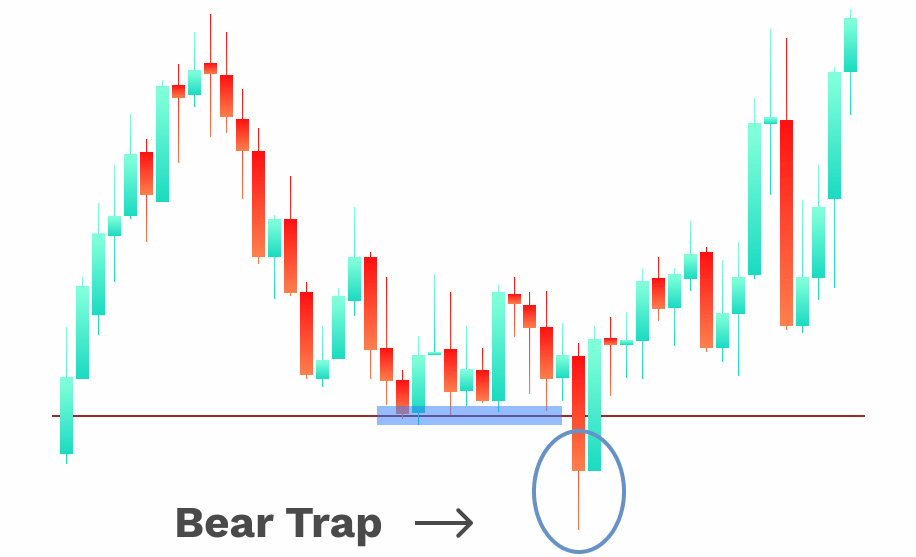

A bear trap occurs when market indicators suggest a cryptocurrency is transitioning from an uptrend to a downtrend — a signal eagerly awaited by bears. These traders are convinced that a price decline is imminent and have opened short positions to capitalize on the expected drop.

However, the downtrend is a false alarm. Instead of continuing to fall, the price suddenly reverses and heads upwards, leaving bears trapped in short positions at a loss if they don’t act quickly to cover.

How Bear Traps Operate

Bear traps typically unfold in phases. Initially, a slight price decline fuels bearish sentiment, encouraging short selling. This selling pressure causes a further drop, validating the bearish outlook. Yet, this is where the trap springs. Fundamental strengths or external factors cause the price to rebound sharply, often accelerated by bears scrambling to cover their shorts, propelling the price even higher.

Spotting a Bear Trap

Recognizing a bear trap can save significant resources and stress for crypto traders and investors. Key indicators include:

- Abrupt Volume Increase: A sudden spike in trading volume without corresponding news or events can signal a bear trap, as it may indicate coordinated buying to reverse the trend.

- Resistance Levels: If the price briefly dips below a key support level only to recover quickly, it may be a bear trap. Watching for these false breakouts is essential.

- Market Sentiment: Extreme bearish sentiment in the market, especially without solid fundamental reasons, can often precede a bear trap. Stay wary of the herd mentality.

Strategies to Avoid Bear Traps

- Set Stop-Loss Orders: Protect your positions with stop-loss orders to minimize losses if the market moves against you.

- Avoid Herd Mentality: Don’t follow the crowd blindly. Analyze the market independently to make informed decisions.

- Wait for Confirmation: Before taking a position based on a supposed downtrend, wait for additional confirmation signals to avoid premature decisions.

- Stay Informed: Stay abreast of market news and trends. Bear traps often occur in the absence of genuine negative news.

Advanced Strategies to Dodge Bear Traps

- Technical Analysis Mastery: Deepen your understanding of technical analysis. Familiarize yourself with a range of indicators that can help identify false downtrends. RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands are tools that, when used together, can offer a clearer picture of the market’s true direction.

- Diversify Trading Strategies: Do not rely solely on one strategy or indicator. The market’s complexity requires a toolbox of techniques. Pair trading, for example, can hedge against unexpected market movements by opening a long position on one asset and a short position on a correlated asset.

- Psychological Preparedness: Bear traps test not only your strategies but also your emotions. Fear and greed are potent forces in trading. Developing a mindset that remains calm and analytical in the face of market manipulations is invaluable. Meditation and regular breaks from trading can help maintain this balance.

- Continuous Learning: The crypto market is dynamic, with new patterns and strategies emerging regularly. Commit to lifelong learning by attending webinars, engaging with trading communities, and reading up on the latest research and trends in the field.

The Role of Community and Information

In the digital age, information travels fast, and sentiments can shift even faster. Engaging with a community of like-minded traders can offer insights and alerts that might be missed when working alone. However, always approach shared information critically and consider the sources before acting on it.

- Use Social Media Wisely: Platforms like Twitter and Reddit can be goldmines for real-time market sentiment and news. Yet, they can also be breeding grounds for misinformation. Learn to distinguish between genuine insights and noise.

- Leverage Trading Platforms’ Tools: Many advanced trading platforms offer tools for sentiment analysis and real-time alerts for sudden market changes. These can be instrumental in avoiding bear traps by providing early warning signs of market manipulation or sentiment shifts.

Comparison with Other Market Phenomena

Here’s how you can contrast the bear trap with other market phenomena

Bull Trap vs. Bear Trap

- Bear Trap: Occurs when prices temporarily decline within a larger uptrend, luring traders into selling positions in anticipation of further declines.

- Bull Trap: In contrast, a bull trap happens when prices briefly rise within a broader downtrend, causing traders to buy in anticipation of a reversal, only for prices to fall again.

Dead Cat Bounce Vs. Bear Trap

- Bear Trap: Typically occurs during a downtrend when prices briefly rally, leading some traders to believe that a reversal is imminent. However, the rally is short-lived, and prices resume their downward trajectory.

- Dead Cat Bounce: Similar to a bear trap, a dead cat bounce refers to a temporary price recovery after a significant decline. However, unlike a bear trap, the dead cat bounce does not necessarily involve luring traders into selling positions.

False Breakout Vs. Bear Trap

- Bear Trap: Involves a deceptive downward movement that tricks traders into selling, only for prices to reverse and move higher, causing losses for those who sold.

- False Breakout: Refers to a deceptive price movement that appears to signal a breakout from a trading range or chart pattern, attracting traders to enter positions. However, the price fails to sustain the breakout and retreats back into the range or pattern.

Embracing the Market’s Volatility!

Ultimately, the market’s volatility is not an enemy but a feature of the cryptocurrency landscape that can offer numerous opportunities for growth and profit when understood and respected. Bear traps, while challenging, teach valuable lessons in market dynamics, risk management, and the importance of a disciplined trading approach.

Remember, every trader encounters bear traps at some point. The difference lies in how you prepare for, react to, and learn from these situations. With the right strategies, mindset, and tools, you can navigate them with greater assurance and continue to thrive in the vibrant world of cryptocurrency trading.

By staying informed, leveraging community wisdom, and refining your trading strategies, you ensure that you’re surviving and thriving, turning potential pitfalls into opportunities for growth. The journey through cryptocurrency markets is one of continuous learning and adaptation. Embrace it with caution and curiosity, and let the adventure guide you to greater heights.