📑Table of Contents:

- Understanding Bull Flag Patterns

- Identifying Bull Flag Patterns

- Trading Bull Flag Patterns

- Case Studies: Successful Bull Flag Trades

- Common Mistakes and How to Avoid Them

- Tools and Resources for Bull Flag Trading

- Advanced Trading Strategies Using Bull Flag Patterns

- Psychological Aspects of Trading Bull Flags

- Risk Management Techniques

- Leveraging Technology in Bull Flag Trading

- Global Market Perspectives

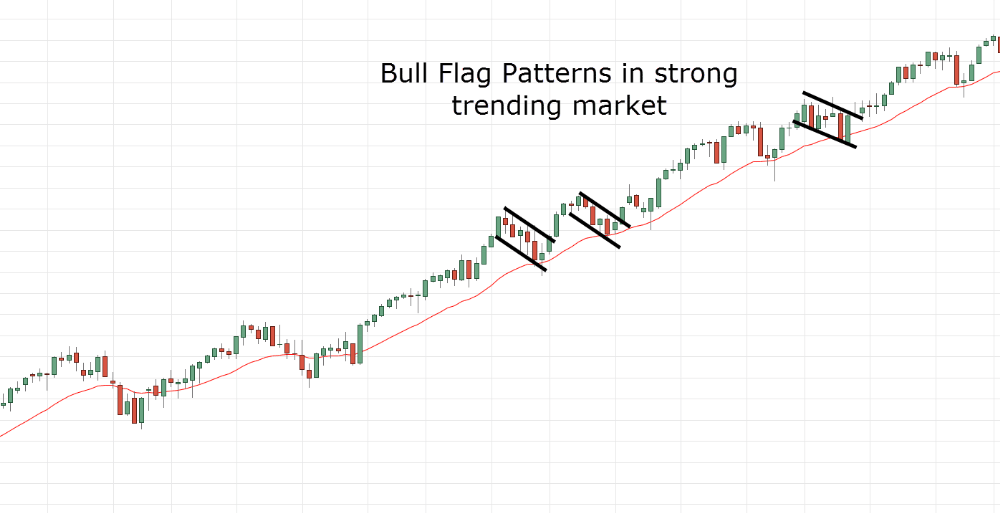

In the dynamic world of trading, the Bull Flag pattern stands out as a powerful signal that many traders leverage to gauge potential bullish continuations. Recognizable by its distinctive shape, this pattern is a beacon for those looking to capitalize on strong upward trends.

This blog post delves into the Bull Flag pattern, from its basics to advanced trading strategies, providing you with the knowledge to spot and execute profitable trades confidently.

Understanding Bull Flag Patterns

A Bull Flag pattern forms when the market experiences a strong upward movement (the flagpole), followed by a consolidation phase that moves slightly downward or horizontally (the flag). This pattern is significant because it signals the possibility of a continuing uptrend after the brief pause.

- Components: A rapid price increase creates the’ flagpole, ‘ while the ‘flag’ represents a period of consolidation with typically lighter volume.

- Flagpole: Rapid price increase signals strong buyer momentum.

- Flag: Consolidation phase; price moves slightly downward or horizontally

- Psychology Behind the Pattern: The consolidation indicates that sellers are not ready to take control, and buyers are likely taking a breather before pushing prices higher again.

- Breakout Expectation: After consolidation, a breakout typically resumes the uptrend.

- Volume Dynamics: Trading volume dips during consolidation and spikes on breakout.

- Duration: Pattern usually forms over a short period, days to weeks.

- Trading Strategy: Entry after breakout, stop-loss below flag low.

- Confirmation: Validated if breakout on high volume.

- Predictive Power: Indicates continuation more than reversal.

- Pattern Variations: Sometimes, slight variations in flag shape or angle appear.

- Market Sentiment: Reflects strong bullish sentiment despite brief pause.

Identifying Bull Flag Patterns

Recognizing Bull Flag patterns requires an eye for detail and an understanding of market movements:

- Volume Analysis: Look for a high volume during the flagpole creation and a decrease in volume during the flag formation.

- Duration: Bull Flag patterns typically do not last very long. Depending on the time frame you are analyzing, a few days to a couple of weeks is common.

- Shape and Structure: The flag should be a small rectangle sloping against the trend, not a significant pullback.

Trading Bull Flag Patterns

Trading Bull Flag patterns effectively involves clear strategy and precise execution:

- Entry Point: Enter a trade when the price breaks above the flag’s upper boundary. An increase in volume often accompanies this breakout.

- Stop Loss: To protect against false breakouts, place a stop loss just below the flag’s lowest point.

- Profit Target: The initial profit target can be estimated by measuring the height of the flagpole and extending that same distance from the point of breakout.

Case Studies: Successful Bull Flag Trades

Analyzing successful case studies helps illustrate how Bull Flag patterns can be traded profitably:

- Example 1: A trader spots a Bull Flag pattern in a tech stock after a strong earnings report causes a sharp price increase. The consolidation lasts one week before a breakout occurs, resulting in a profitable exit.

- Example 2: In the forex market, a currency pair exhibits a Bull Flag pattern during a market sentiment shift. The trader capitalizes on this by buying at the breakout, achieving substantial gains by the projected target.

Common Mistakes and How to Avoid Them

Even experienced traders can make mistakes when dealing with Bull Flag patterns:

- Premature Entry: Avoid entering the trade before the actual breakout occurs, as it can lead to being caught in a false signal.

- Ignoring Overall Market Conditions: Always consider broader market trends and indicators. Bull Flag patterns work best in bullish markets.

- Neglecting Volume: Volume should confirm the breakout. Without volume confirmation, the reliability of the pattern decreases.

Tools and Resources for Bull Flag Trading

Several tools and resources can enhance your ability to identify and trade Bull Flag patterns:

- Technical Analysis Software: Platforms like TradingView or MetaTrader offer tools for drawing and spotting patterns based on preset criteria.

- Educational Resources: Books, courses, and webinars focused on pattern trading can provide deeper insights and practical tips.

- Real-Time Alert Services: Notify traders instantly of potential bull flag formations in selected markets.

- Experienced Community Forums: Gain insights and strategies from seasoned traders sharing real-world experiences.

- Historical Data Analysis: Utilize backtesting software to evaluate the effectiveness of bull flag strategies over time.

Advanced Trading Strategies Using Bull Flag Patterns

Bull Flag patterns are not only effective in straightforward scenarios but can also be integrated into more complex trading strategies:

- Combining with Other Indicators: To increase the reliability of Bull Flag signals, traders often combine them with other technical indicators such as moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence). For instance, a moving average crossover can confirm the momentum expected from a Bull Flag breakout.

- Scaling In and Out: Advanced traders might scale into a position as the flag forms and add to it upon breakout, maximizing their potential gain while managing risk effectively.

Psychological Aspects of Trading Bull Flags

Understanding the psychology behind price movements in Bull Flag scenarios can provide traders with a competitive edge:

- Market Sentiment: Often, the flag portion of the pattern represents a period of consolidation where the market sentiment is tested. A breakout is a sign of prevailing bullish sentiment overpowering any bearish trends.

- Trader Behavior: During the flag formation, impatience can lead to premature exits. Successful traders recognize this and maintain discipline, waiting for clear signals before committing to their moves.

Risk Management Techniques

Effective risk management is crucial when trading Bull Flag patterns:

- Position Sizing: Proper position sizing ensures that even if a trade does not go as planned, the loss does not significantly impact the overall portfolio.

- Multiple Time Frame Analysis: Using various time frames to analyze Bull Flag patterns can provide a more comprehensive view of potential trend continuations or reversals, helping to manage risk better.

Leveraging Technology in Bull Flag Trading

Modern technology plays a pivotal role in identifying and trading Bull Flag patterns:

- Algorithmic Trading: Some traders use algorithms to automatically detect Bull Flag patterns and execute trades based on predefined criteria, enhancing speed and efficiency.

- Backtesting Software: Before applying a Bull Flag trading strategy in real markets, it can be backtested using historical data to assess its viability and refine the approach.

Global Market Perspectives

The effectiveness of Bull Flag patterns can vary across different global markets due to varying liquidity and volatility:

- Equities vs. Forex: Bull Flag patterns are common in equities and forex, but the strategies might slightly differ due to the 24-hour nature of forex markets and the typically higher volatility.

- Emerging Markets: In emerging markets, the Bull Flag pattern may exhibit different characteristics, such as longer consolidation phases, requiring adjustments in trading strategies.

Conclusion

The Bull Flag pattern is a versatile and powerful tool in trading that, when mastered, can significantly enhance your trading strategies. By understanding not just the basics but also the deeper insights and advanced tactics discussed here, traders can better navigate the complexities of market dynamics and achieve greater success.

As with any trading strategy, continuous learning and adaptation are key to maintaining an edge in the ever-changing financial markets.