📑Table of Contents:

Cash App, a popular mobile payment service, offers a variety of features to make managing money easier. One of these features is the ability to borrow money directly through the app. If you’re wondering how the Cash App borrow limit works and how you can make the most of it, you’re in the right place. This blog post will explore everything you need to know about the Cash App borrow limit, including how to increase it and tips for responsible borrowing.

What is Cash App Borrow?

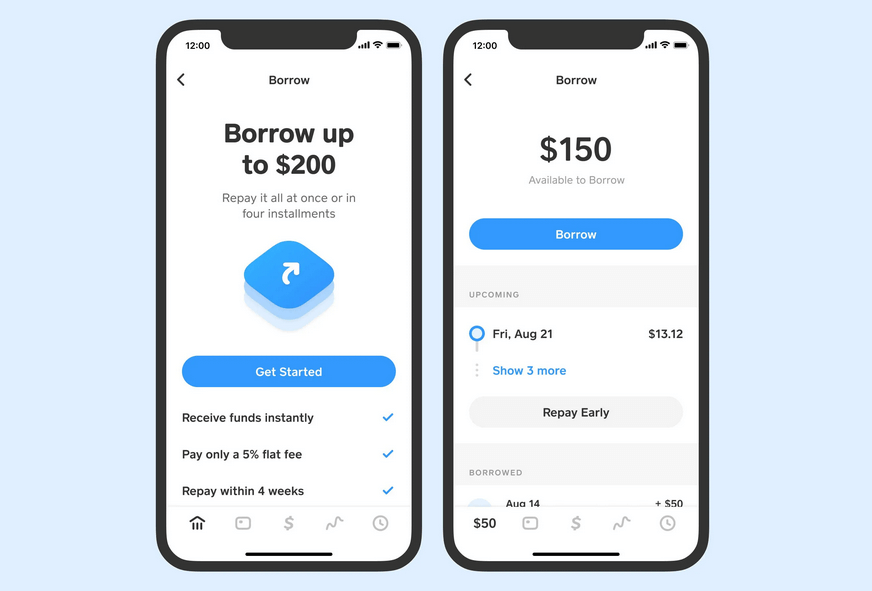

Cash App Borrow is a feature that allows eligible users to borrow a small amount of money directly from their Cash App balance. It’s designed for short-term financial needs, offering a quick and convenient way to access funds. Unlike traditional loans, Cash App Borrow is more straightforward and accessible, making it an attractive option for those who need cash fast.

How Does the Cash App Borrow Limit Work?

The Cash App borrow limit refers to the maximum amount of money you can borrow. This limit varies depending on several factors, including your app usage, transaction history, and creditworthiness. Typically, the borrowing limit ranges from $20 to $200, which can change over time based on your account activity.

- Initial Borrow Limit: When you first gain access to the borrow feature, your limit may be lower. Cash App typically starts users with a small limit to assess their borrowing behavior.

- Increased Borrow Limit: If you repay your borrowed amounts on time and use Cash App regularly, your borrowing limit may increase. Regular transactions, prompt payments, and positive account activity contribute to a higher limit.

How to Check Your Cash App Borrow Limit

Checking your borrow limit on Cash App is simple. Follow these steps to find out how much you can borrow:

- Open Cash App: Launch the app on your mobile device.

- Go to the Banking tab: Tap on the Banking tab, which is represented by a bank icon on the home screen.

- Select “Borrow”: If you’re eligible, you’ll see the “Borrow” option listed under your account balance.

- View Your Borrow Limit: Tap “Borrow” to view your current borrow limit and the terms associated with borrowing.

Factors That Affect Your Cash App Borrow Limit

Several factors influence your Cash App borrow limit. Understanding these can help you manage your account better and potentially increase your limit over time.

1. Account Activity

Regularly using Cash App for transactions like sending and receiving money, paying bills, or making purchases can positively impact your borrowing limit. The more active your account is, the higher your borrowing limit will likely be.

2. Repayment History

Your repayment behavior plays a significant role in determining your borrowing limit. Cash App may increase your limit over time if you repay borrowed amounts promptly and consistently. On the other hand, late payments or defaults can lead to a reduced limit or even loss of access to the borrow feature.

3. Creditworthiness

While Cash App Borrow does not require a traditional credit check, your overall financial behavior within the app is considered. This includes your transaction history, how often you use the app, and how you manage borrowed funds responsibly.

4. Frequency of Borrowing

Cash App may gradually increase your limit if you borrow money frequently and repay it on time. However, if you borrow sporadically or struggle to repay, your limit might stay low or decrease.

Tips for Increasing Your Cash App Borrow Limit

If you want to increase your Cash App borrow limit, here are some practical tips:

1. Use Cash App Regularly

The more you use Cash App, the more likely you are to increase your borrowing limit. Make Cash App your go-to platform for transactions like paying friends, shopping online, or managing bills.

2. Repay on Time

Always repay borrowed amounts by the due date. Timely repayments demonstrate financial responsibility and can lead to a higher borrowing limit in the future.

3. Maintain a Positive Balance

Keep a positive balance in your Cash App account whenever possible. This indicates that you manage your funds well and are less likely to default on borrowed amounts.

4. Avoid Over-Borrowing

Borrow only what you need and can afford to repay. Overborrowing or struggling with repayments can negatively impact your limit.

Pros and Cons of Cash App Borrow

Like any financial product, Cash App Borrow has its advantages and disadvantages. It’s important to weigh these before deciding to borrow.

Pros:

- Quick Access to Cash: Cash App Borrow offers immediate access to funds, which can be helpful in emergencies.

- No Credit Check: Cash App does not perform a traditional credit check, making it accessible to those with poor or no credit history.

- User-Friendly: The borrow feature is easy to use, with clear terms and a straightforward application process.

Cons:

- Low Borrow Limits: The maximum amount you can borrow is relatively low, which may not be sufficient for larger financial needs.

- Fees and Interest: Cash App Borrow may include fees and interest, which can add to the cost of borrowing.

- Limited Availability: Not all users are eligible for Cash App Borrow, and availability may vary based on location and account activity.

Is Cash App Borrow Right for You?

Cash App Borrow can be a useful tool for managing short-term financial needs. However, it’s essential to use it responsibly. Cash App Borrow might be a good option if you need a small amount of money quickly and can repay it promptly. But if you’re struggling with ongoing financial issues, it’s important to consider other solutions that offer more substantial support.

When to Use Cash App Borrow:

- Emergency Expenses: When you need to cover an unexpected bill or urgent expense.

- Temporary Cash Flow Issues: If you’re waiting for your next paycheck and need a small advance.

- Avoiding Overdraft Fees: To prevent overdrawing your bank account and incurring fees.

When to Consider Alternatives:

- Large Financial Needs: If you require more significant funds, look into personal loans or other financial products.

- Debt Management: If you’re already struggling with debt, consider seeking help from a financial advisor before taking on more.

Conclusion

The Cash App borrow limit is a convenient feature for users who need quick access to funds. By understanding how the borrow limit works and the factors that influence it, you can make informed decisions and use this feature to your advantage. Remember to borrow responsibly, repay on time, and manage your Cash App account wisely to increase your borrowing limit potentially.

As with any financial product, weighing the pros and cons and considering whether Cash App Borrow is the right solution for your financial needs is important. Following the tips outlined in this post, you can confidently navigate the borrowing process and avoid common pitfalls.