📑Table of Contents:

Credit Karma Money is updating its Terms of Service for its Spend checking account and Save account, which will come into effect on June 3, 2024. A significant change is introducing a $2.50 fee for out-of-network ATM withdrawals for certain members. This fee will apply to withdrawals from ATMs outside the Allpoint network unless members meet specific criteria.

Background on Credit Karma Money

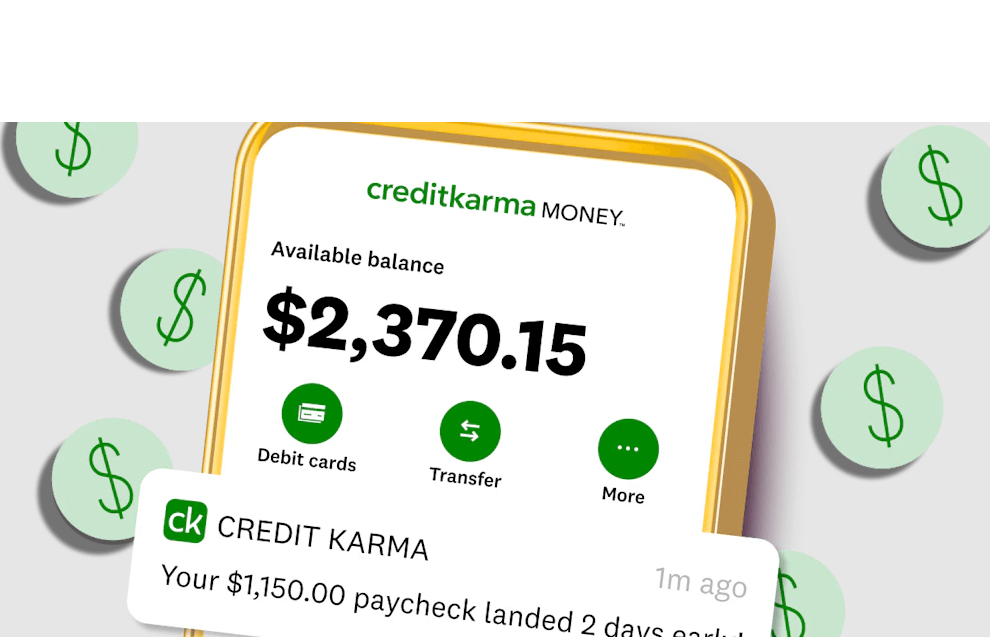

Credit Karma Money is a banking service offered by Credit Karma, a prominent financial technology company known for its credit monitoring and financial management tools. Here’s an overview of Credit Karma Money and its key attributes:

1. Banking Service by Credit Karma:

- Credit Karma Money represents Credit Karma’s foray into the banking sector, expanding its offerings beyond credit monitoring and financial education.

2. Features and Benefits:

- Fee-Free Banking: Credit Karma Money distinguishes itself by offering fee-free banking services, including no monthly maintenance fees, overdraft fees, or minimum balance requirements.

- High-Yield Savings: Users can earn competitive interest rates on their savings through Credit Karma Money’s high-yield savings account, helping them grow their money faster.

- Early Paycheck Access: It also provides users with the option to receive their paychecks up to two days early through direct deposit, offering greater financial flexibility.

- Savings Goals: The platform allows users to set savings goals and track their progress, empowering them to achieve their financial objectives more effectively.

- FDIC Insurance: Funds deposited in their accounts are FDIC-insured up to certain limits, providing users with peace of mind and protection against loss.

3. Target Audience:

- Credit Karma Money is designed to cater to a broad audience of consumers seeking accessible, transparent, and user-friendly banking services.

- It particularly appeals to individuals who prioritize fee transparency, competitive interest rates, and modern digital banking features.

- Millennials and younger demographics, in particular, may find Credit Karma Money appealing due to its emphasis on simplicity, convenience, and financial empowerment.

Credit Karma Money aims to provide users with a seamless banking experience that aligns with its mission of helping people make financial progress. By offering fee-free banking, competitive interest rates, and innovative features, it seeks to empower users to take control of their finances and achieve their financial goals more efficiently.

Details of the TOS Update

Members must have a connected paycheck or direct deposit totaling at least $750 in a calendar month to avoid this fee. Despite this change, members can still make free withdrawals at over 55,000 Allpoint ATMs nationwide, which can be easily located using the Credit Karma app. Additionally, it’s important to note that out-of-network ATM transactions may incur additional charges the ATM operators impose.

The Terms of Service update also includes revisions to the Arbitration section, ensuring clarity and fairness in resolving disputes. These changes are designed to improve user experience and maintain transparency in Credit Karma Money’s operations.

Users are accepting these updated terms by continuing to use Credit Karma Money’s products and services after June 3, 2024. All users should review these changes thoroughly to understand how they may be affected and take advantage of the free ATM withdrawal options within the Allpoint network whenever possible.

Reasons for the Update

The decision to update the ATM fees for Credit Karma Money users was driven by several factors and considerations aimed at improving the overall banking experience and aligning with industry trends. Here are the key reasons behind the update:

1. Cost Management:

- The update may be a response to rising operational costs associated with ATM usage, including transaction processing fees and network charges. Adjusting ATM fees allows them to manage costs more effectively while continuing to offer competitive banking services.

2. Enhanced User Experience:

- It may have identified opportunities to enhance the user experience by optimizing its fee structure. By updating ATM fees, the platform aims to provide users with greater transparency, convenience, and value when accessing cash through ATMs.

3. Competitive Positioning:

- It also adjusts ATM fees to stay competitive amidst market changes. Aligning fees with industry norms or customer expectations helps Credit Karma Money stay competitive and retain customers.

4. Customer Feedback:

- Customer feedback and insights may have played a role in informing the decision to update ATM fees. User feedback likely prompted Credit Karma Money to adjust ATM fees for better alignment with user preferences.

5. Regulatory Compliance:

- Regulatory changes could require ATM fee updates for compliance with legal standards. Compliance with industry regulations such as the Electronic Funds Transfer Act (EFTA) and the Truth in Savings Act (TISA) is essential for financial institutions like Credit Karma Money.

6. Market Trends and Practices:

- Consumer behavior changes, technology advancements, and industry standards influence Credit Karma Money’s ATM fee updates. Credit Karma Money adjusts fees to stay competitive amid changing market trends.

Impact on Users

The TOS update regarding ATM fees for Credit Karma Money users is poised to have a notable impact on users’ access to ATMs and associated fees. Here’s a discussion of the potential effects, including benefits and drawbacks:

1. Access to ATMs:

- Benefit: The update may result in expanded access to ATMs for Credit Karma Money users by adjusting fees or partnering with additional ATM networks. This could enhance convenience and flexibility for users, especially those in areas with limited ATM options.

- Drawback: Conversely, there could be limitations or changes to the ATM network, potentially reducing access to certain ATMs or increasing fees for out-of-network withdrawals. Users may need to adjust their ATM usage habits or seek alternative banking options to mitigate any inconvenience.

2. Fee Transparency:

- Benefit: The TOS update may improve fee transparency for users by clarifying the costs associated with ATM usage. Clear and transparent fee structures empower users to make informed decisions about their banking activities and better manage their finances.

- Drawback: However, if the update results in higher ATM fees or additional charges, users may experience financial strain or dissatisfaction. Increased fees could impact users’ perceptions of Credit Karma Money and influence their banking choices.

3. Financial Impact:

- Benefit: For users who frequently access ATMs, the TOS update may lead to cost savings if fees are reduced or if Credit Karma Money introduces fee reimbursement programs. These cost savings can contribute to improved financial well-being and overall satisfaction with the banking service.

- Drawback: Conversely, if ATM fees are increased or if users incur additional charges, it could have a negative financial impact, particularly for those on tight budgets or with limited access to fee-free ATMs. Users may need to reassess their banking needs and evaluate alternative banking options to minimize costs.

4. User Experience:

- Benefit: Overall, the TOS update has the potential to enhance the user experience by streamlining ATM access, improving fee transparency, and aligning with user preferences and needs. A positive user experience fosters loyalty and satisfaction, strengthening the relationship between Credit Karma Money and its users.

- Drawback: However, if users perceive the TOS update as unfavorable or if it results in inconvenience or financial strain, it could detract from the overall user experience. Negative experiences may lead to user dissatisfaction, increased churn, and reputational damage for Credit Karma Money.

Final Thoughts!

In summary, the TOS update regarding ATM fees for Credit Karma Money users presents both opportunities and challenges. While it may enhance access to ATMs, improve fee transparency, and positively impact the user experience for some users, it could also result in limitations, increased fees, or financial implications for others. It’s essential for users to carefully review the TOS update, assess its impact on their banking needs, and make informed decisions accordingly.