📑Table of Contents:

Last updated on February 11th, 2022 at 12:28 pm

We have tried several different ways to process Stripe transactions to Quickbooks.

- Quicbooks and Stripe DOES not have a direct app/connection.

- Need to go through 3rd party app/service.

- We tried Sushi.io, Automate.io, PayPal|Stripe|Square sync – PayTraQer, etc, DON’T work well. With Sush.io, you have NO control on what is importing, it just syncs the data and it’s hard to monitor.

- We chose https://paytracker.saasant.com/paytracker/transactions/notsynced and we found it easy to work, follow the steps below.

STEPS on how to process transactions from Stripe to Quickbooks via SaaSant.

Software: https://paytracker.saasant.com/paytracker/transactions/notsynced

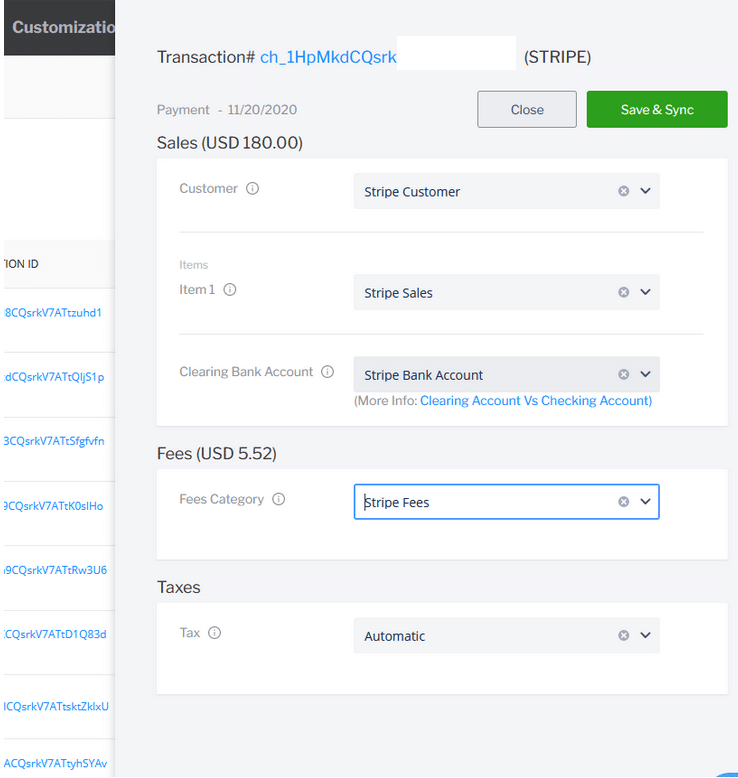

Process SALES

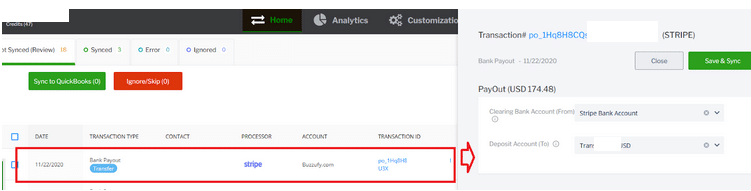

- Push to QB – each SALE to record revenue + fees.

- Must match the “accounts” well, all “stripe” markers

DEPOSIT (transfer to bank account)

3. After SALE is recorded, do the DEPOSIT sync.

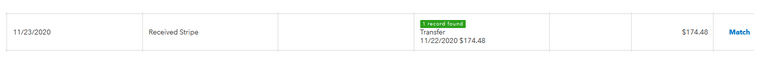

4. BANKING, match transfer from “Stripe Bank acc” → “Transferwise” bank

https://qbo.intuit.com/app/banking

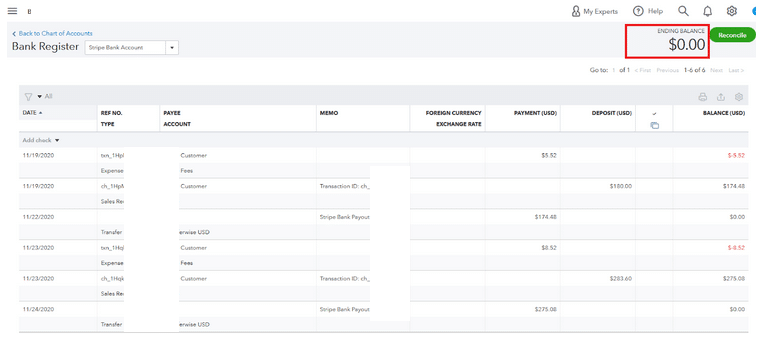

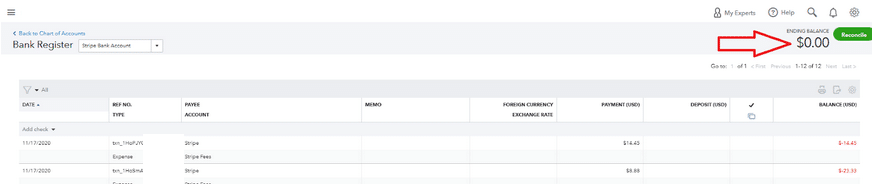

5. After MATCH transfer, go here and make sure BALANCE is $0 = so all matches.

Stripe Bank Register: https://qbo.intuit.com/app/register?accountId=34592

Transaction in EURO.

- Process in all USD accounts (client, bank account). This is recommended to avoid another account in EURO and MOST importantly, when you match the transfers, the amounts will match. If you have 2 accounts in USD/EURO, and the transfer from Stripe contains transactions in EURO and USD, the transfer will NOT MATCH.

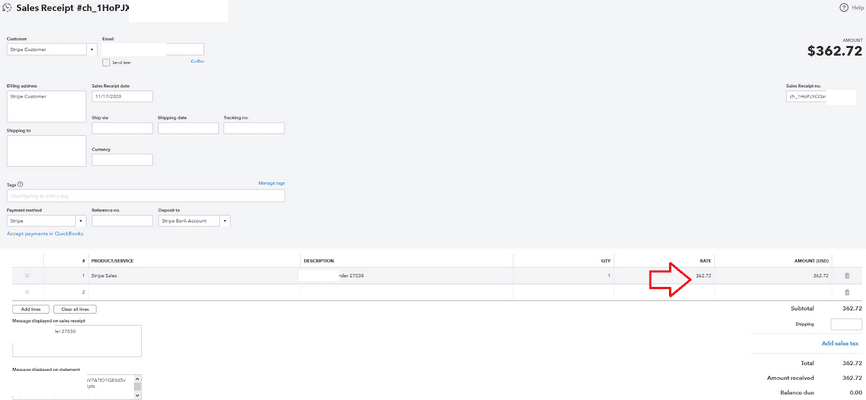

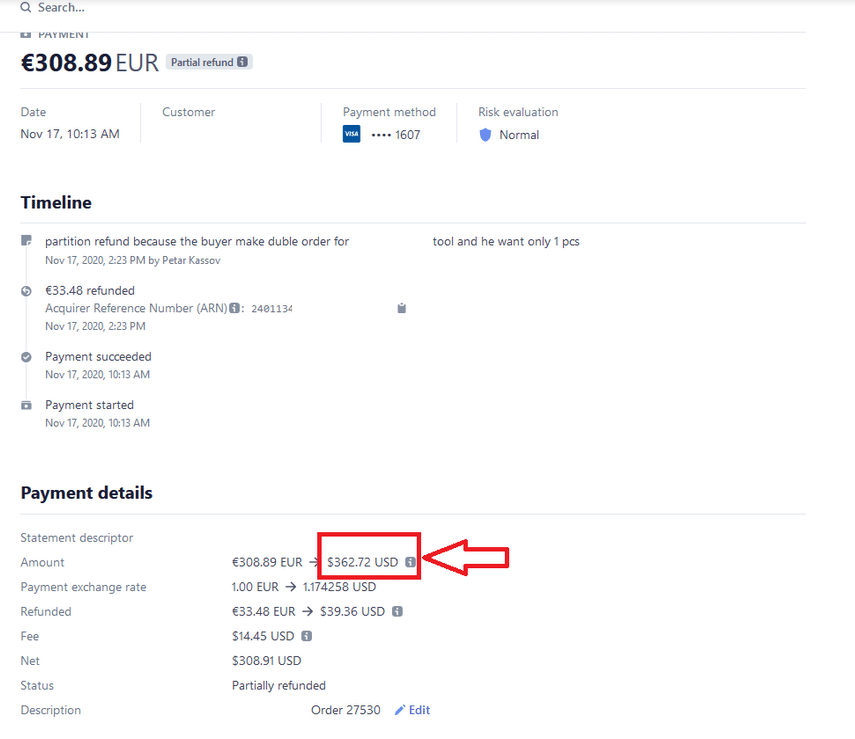

- when processed, go to QB and change the amount to match Stripe amount in USD

https://qbo.intuit.com/app/salesreceipt?txnId=XXXX

- MATCH stripe amount

https://dashboard.stripe.com/payments/pi_1HoPJWCQsrkV7-EXAMPLE-4OCP

REFUND in EURO

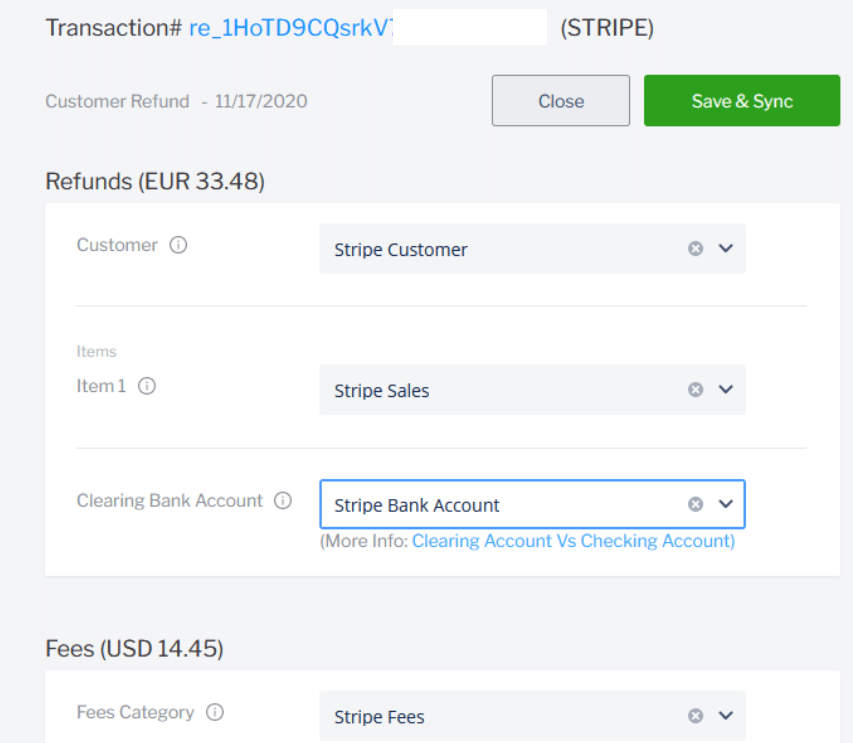

- Find the transaction in and process in USD https://paytracker.saasant.com/paytracker/transactions/notsynced

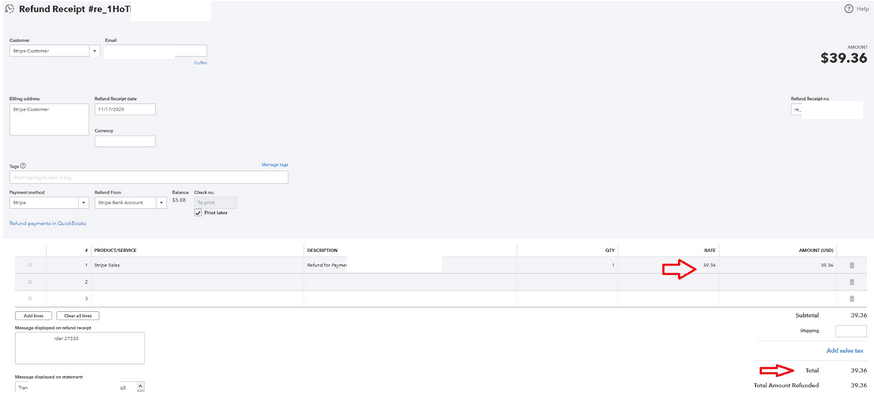

- Same process as SALE, change the amount in QB to USD based on exchange rate of Sripe’s transaction

https://qbo.intuit.com/app/refundreceipt?txnId=4516283

- After each sale or refund processed in QB, the bank register for strip need to be $0.00

https://qbo.intuit.com/app/register?accountId=8912382

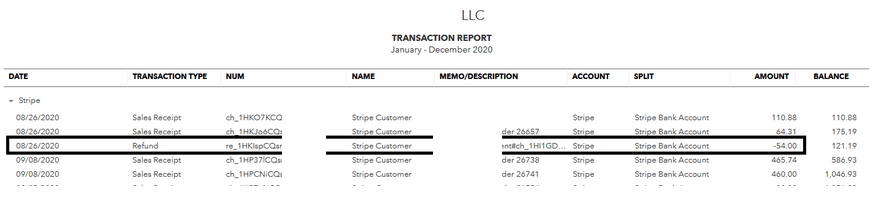

REFUNDS

- Process refunds same way as SALE, select customer “Stripe”, etc. while syncing to Quickbooks.

- The Refund will show automatically in the P&L as “refund”

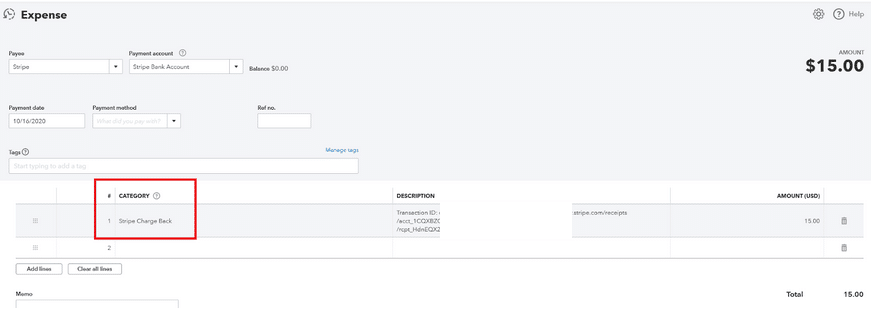

CHARGEBACK

Need to record a REFUND and EXPENSE for the fee, 2 separate transactions

- Go to search (upper/right corner), type “refund” and you will be able to add a refund.

- For the refund, add the original Stripe transaction ID, so you have track of it.

- Select “Stripe Refunds”

- For the FEE: Add new “EXPENSE” and select type “Stripe Charge Back”.

- It is usually $15

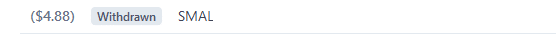

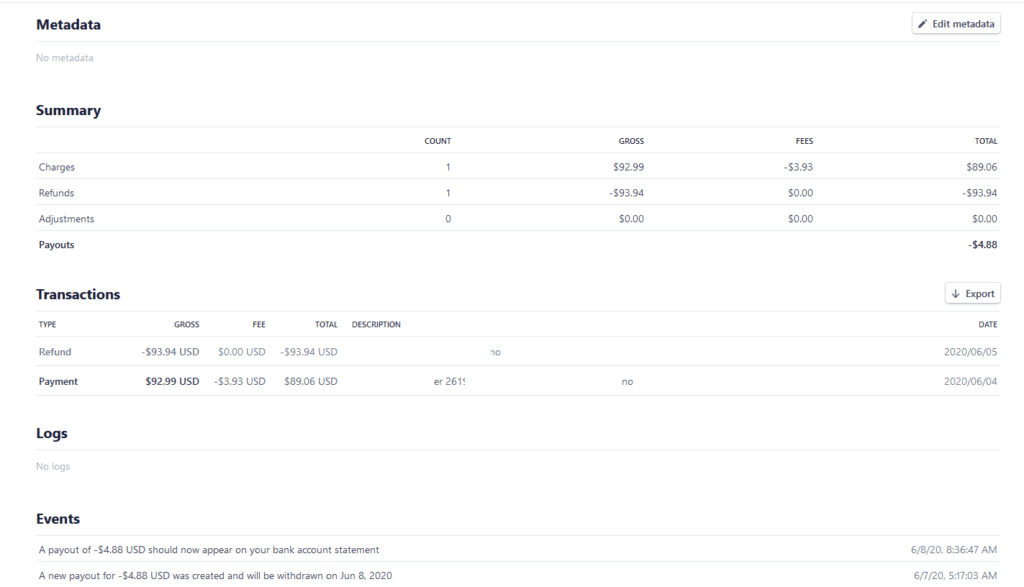

WITHDRAWAL by Stripe (difference in refund amount)

Be careful when you do a refund, as the amount maybe LARGER than what you have charged. If you wordpress woocommerce, this may happen, so just double check the transaction.

IMPORTANT: before you record as expense, check if there is another “Bank Deposit/Withdrawal” transaction.

Here is the difference that may happen by different exchange rates. Charge is for one amount, then refund is larger amount:

How to fix? Record that as a Stripe fee and make a note “refund difference possibly by exchange rate”. The money went to Stripe, so this is an expense and can be recorded as Stripe Fee.

Sign up for Quickbooks here and get FREE months >>