Last updated on December 19th, 2020 at 05:40 pm

PayPal charges high fees for international payments. If your source balance is in US dollars and want to pay in Euros, for a European payment, PayPal charges a lot of fees. Fees are as follows:

- the fee for international transactions is additional 5% of the converted total (minimum is $0.99, maximum fee is $4.99).

- for all cross-currency transfers/payments, you’ll pay additional fee of 2.9%, plus a fixed fee in the range of $0.15 and $0.55

In short: PayPal charges super HIGH fees for all payments, where an exchange rate needs to be applied.

Below, please find a case study on 1 PayPal transaction, showing an example of HOW TO PAY for all of your international transactions to lower the fees and save money.

CASE STUDY on how to save on conversion rate and fees when sending PayPal international

- Login to your PayPal account.

- Go to SEND money: https://www.paypal.com/myaccount/transfer/homepage/pay

- Enter amount to send, in our example will be €1135 sent for the USA to recipient in Europe.

- You will have an option to pick and use your USD PayPal balance – which is the WORST conversion rate.

- In our example, we hold a balance in USD and the remaining amount, PayPal suggests we pay via our credit card. But still, the majority of the payment ($1283.17) will be using default PayPal exchange rate + fee.

OR

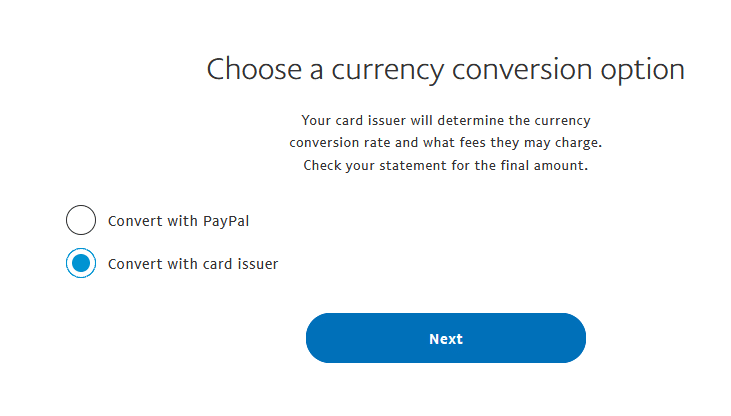

- BEST OPTION: Pick a conversion rate by your bank. Usually, in recent years, US banks have improved conversion rate, close to market rate. Only American Express still charges international transaction fee, as separate transaction.

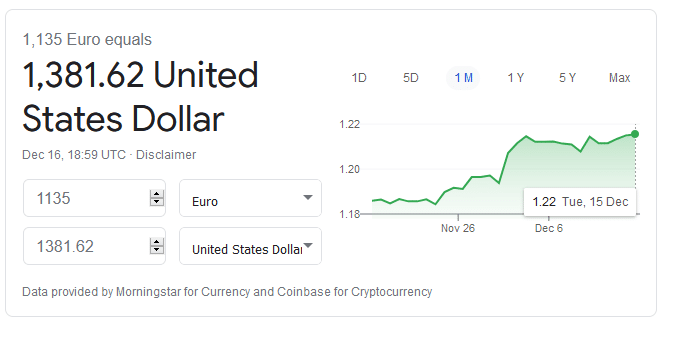

- This it the MARKET rate at the time of sending the PayPal payment in Euros.

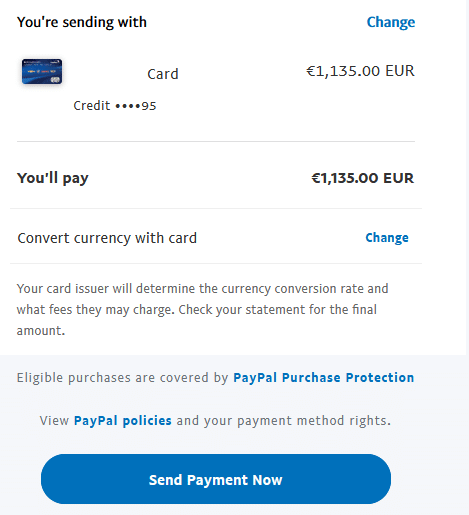

- Our example, again, will show how we are sending €1135 from USA to European account.

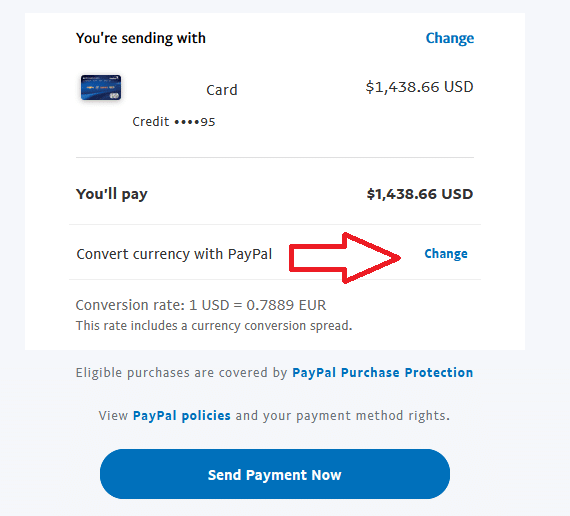

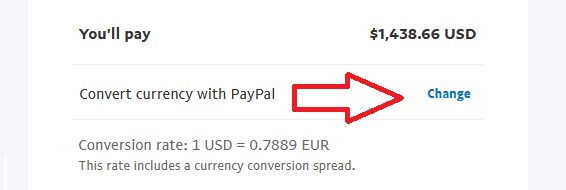

- If you select the default rate of PayPal, in our example, you will pay $1438.66:

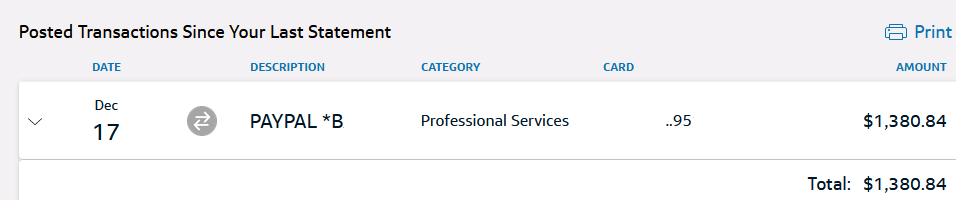

- If you select a rate with your credit card issuing bank, the total was (we waited 3 days for the amount to clear and show on our credit card statement): $1,380.84 (SUPER close to market rate at that time!)

- IMPORTANT: when switching to your credit card, YOU STILL MUST click on “change”. As PayPal makes it a bit harder to switch to your credit card’s exchange rate. It is confusing, and don’t forget to change it 🙂

- Confirm conversion rate “Convert with card issuer”.

- Click NEXT >> Send Payment Now. And you are done!

To summarize: we saved $57.82

$1,438.66 PayPal Rate vs. $1,380.84 Bank Rate for the same purchase

These are all steps outlined above. Supported by images to provide better understanding of the PayPal fees for international currency transfers. Once again, pay close attention as they are several steps/clicks to get to the right setting = charging the TOTAL amount to your bank’s card.

Good luck and please like/share this article. Leave comment if you have similar experience or want to add something to our case.